Experience Matters

Our concierge model offers a higher level of personalized financial service, putting the focus on planning and optimization. Imagine a personalized, meaningful, client-advisor relationship coupled with the latest resources to create customized plans. We’ll work with you to develop a plan that supports your dreams, needs and financial independence. Our holistic approach begins with getting to know more about you because the real value in what we do is not found in the numbers, but in the lives we transform. We integrate your current priorities, uncover any inefficiencies and identify an action plan so you feel more confident and informed about your financial future.

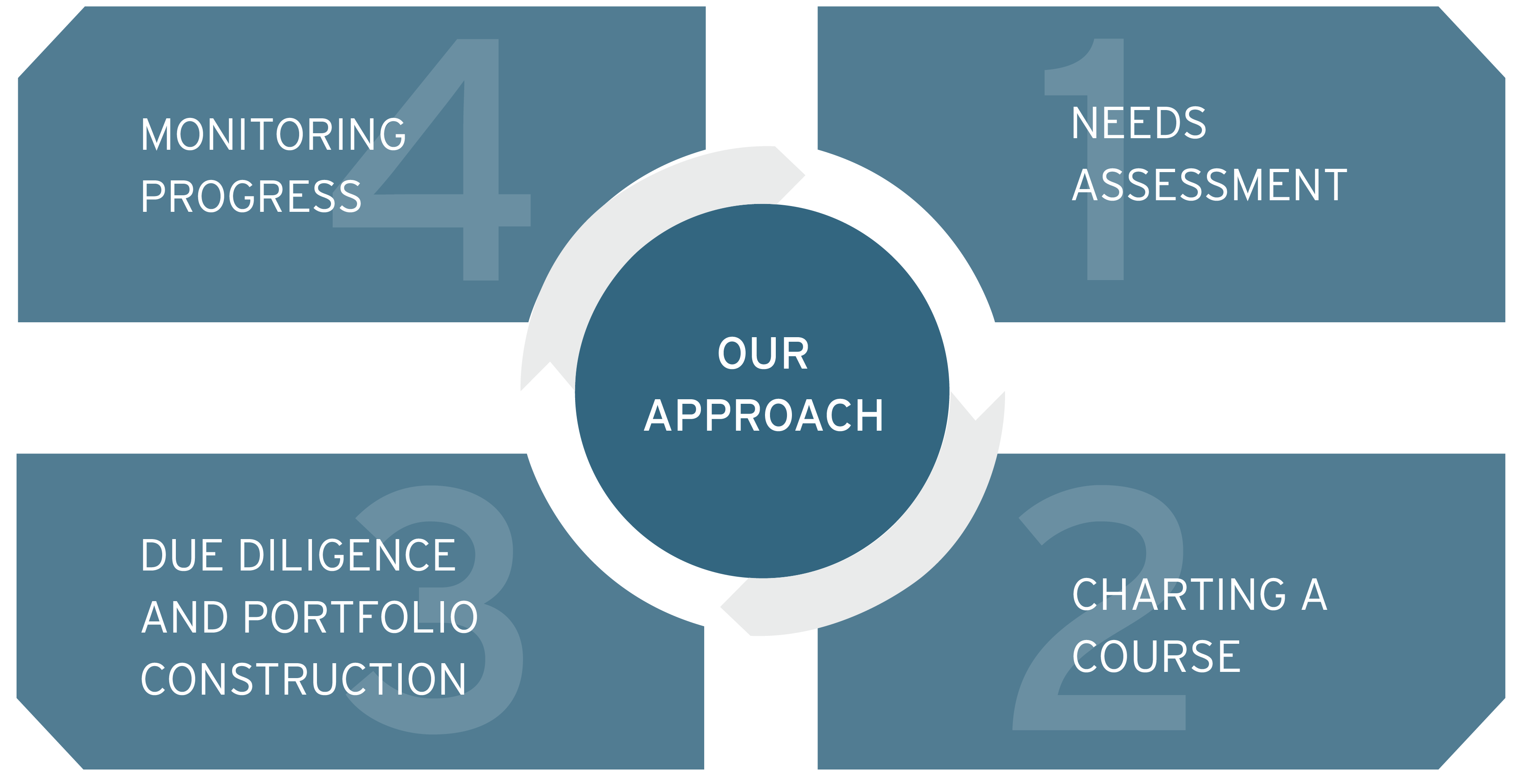

NEEDS ASSESSMENT

Our clients seek our advice for a wide variety of concerns. Whether it is assisting with trust work, providing advice on the sale or acquisition of a business, gifting, cash management, post-retirement issues, or simply addressing asset allocation needs, we will make recommendations on how to move forward.

CHARTING A COURSE

Once we have identified your goals and discussed any issues, we will create a plan for the future. As we move forward, the concierge process will shine a light on any inefficiencies that may inspire a change of course. We do more than deliver a plan. We create a personalized road map that leads to the future you want; it’s designed to be iterative in order to navigate the ever-changing landscape along the way.

DUE DILIGENCE & ASSET ALLOCATION

Based on your need’s assessment and financial plan, we will determine the proper asset allocation. Once that is established, we create the plan comprised of the most appropriate products and solutions. The RDM Investment Committee meets regularly to discuss market trends, individual names, sector weightings, and investment manager due diligence. We continually evaluate, iterate and optimize the plan.

MONITORING PROGRESS

As part of our client-centric concierge model, we regularly monitor progress and work hard to keep our clients in the know. In addition to portfolio performance reviews, we deliver market updates, quarterly commentary, financial plan adjustments, invitations to client appreciation events and more. When it comes to building strong client-advisor relationships, communication is key. That’s why our concierge model works.

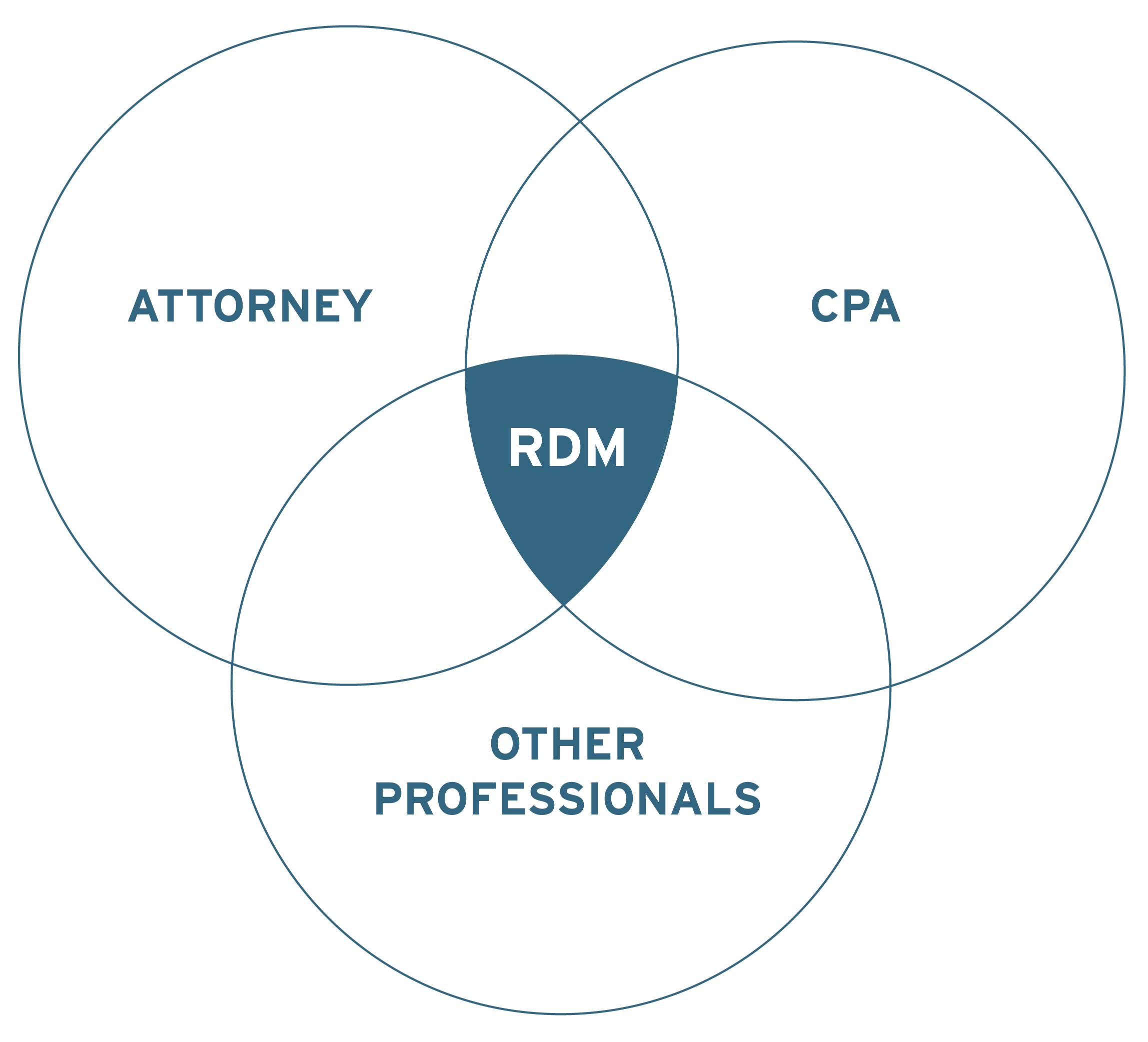

Coordination With Your Professional Team

As we attempt to uncover your financial blind spots, we coordinate with you and your other advisors. We will collaborate with them and implement new strategies tailored to your specific needs.

We are able to provide your attorneys and tax professionals with a detailed analysis of your assets and current tax situation. Our technology wiII provide your professional team with direct access to a secure virtual vault accessible to your legal, tax, and financial statements and documents on a real time basis.

10 Wright St. 1st Floor

Westport, CT 06880

Office: (203) 255-0222

Fax: (203) 255-5333

Toll free: (800) 899-3219

6501 Congress Avenue

Boca Raton , FL 33487

Office: (561) 393-8500

Toll free: (800) 899-3219

300 Madison Ave, 29th Floor

New York, NY 10017

Office: (212) 682-2200

Overview

About Us

- Team

- Our Approach

- Community

- Awards & Accolades

Services

Resources

- Wealth Planning Corner

- Investment Insights

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Securities offered through Hightower Securities, LLC, Member FINRA/SIPC, Hightower Advisors, LLC is a SEC registered investment adviser. brokercheck.finra.org

©2025 Hightower Advisors. All Rights Reserved.